- Home

- About us

- Products

Creative, Premium & Scalable Solutions For Business

HR Solution

Business Solution

Finance Solution

Add On Solution

- Partner Program

- Blog

- Contact Us

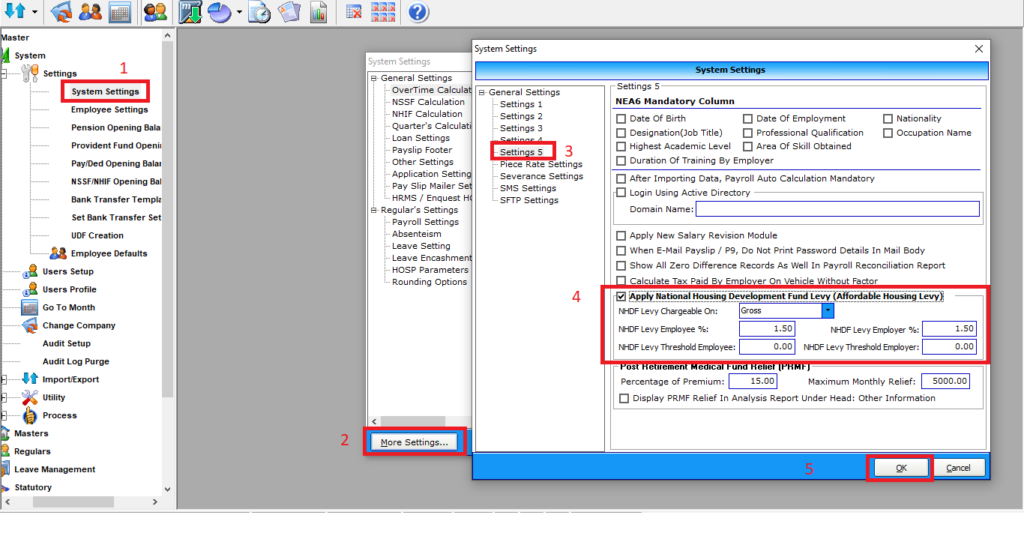

Following changes which affects Payroll Needs to be implemented Effective from 01JUL2023.

Important Note :

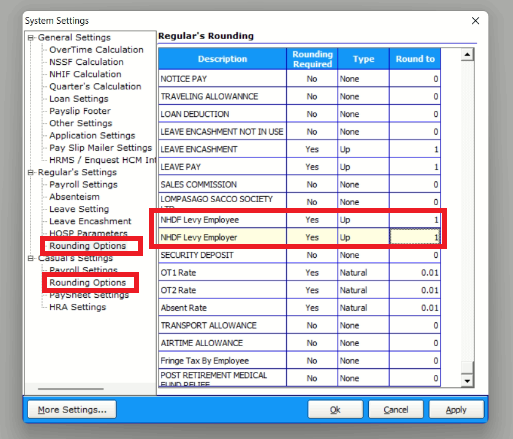

It is advisable to set Upward Rounding for National Housing Development Levy as mentioned in following screenshot

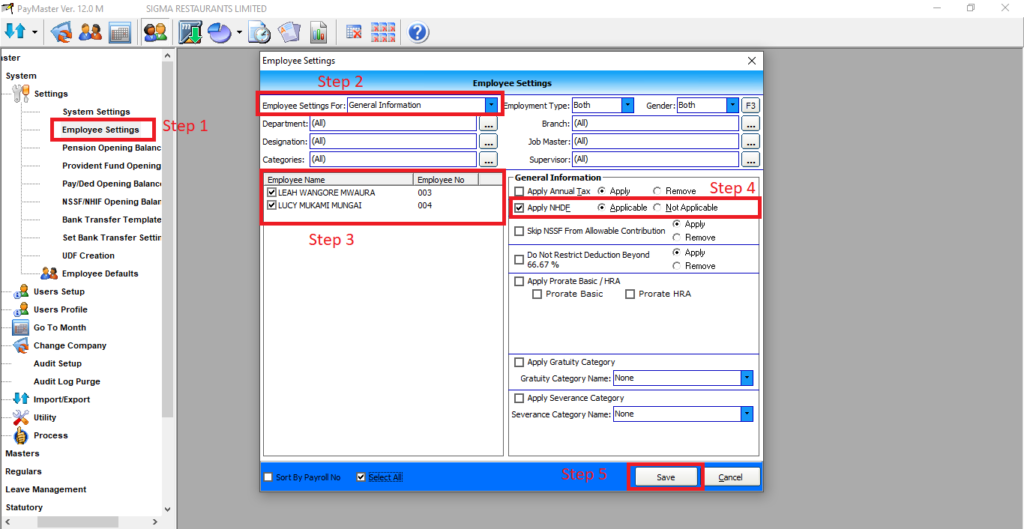

In Paymaster we have given an Option to Set NHDL at Employee Level, To Enable NHDL for all Employees follow these steps

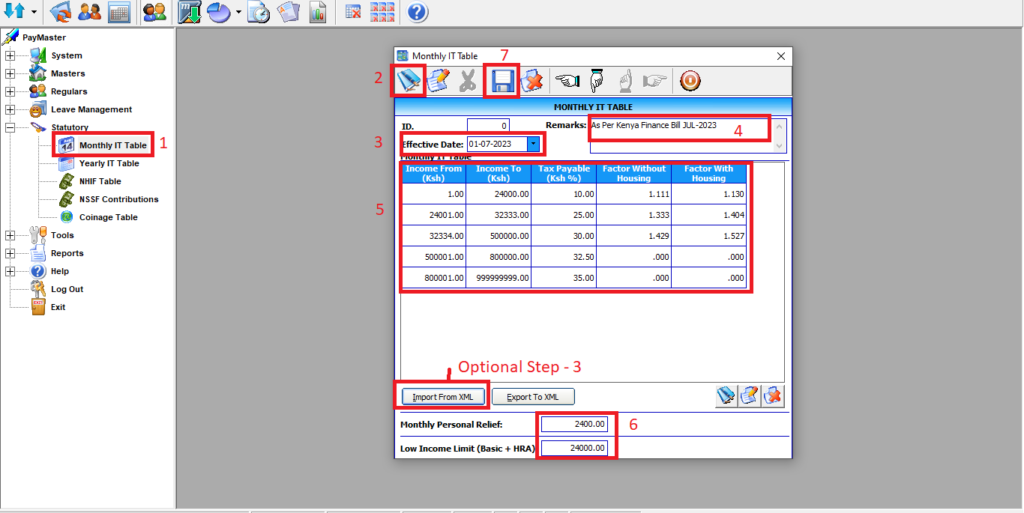

Montly Tax Table

Note : You can even Import the Tax Table Directly via File distributed by Endeavour Africa Ltd. In this case Follow Step 1, 2 in Above screenshot. Then Proceed to Import From XML (Optional Step 3) & Click Save (Step 7)

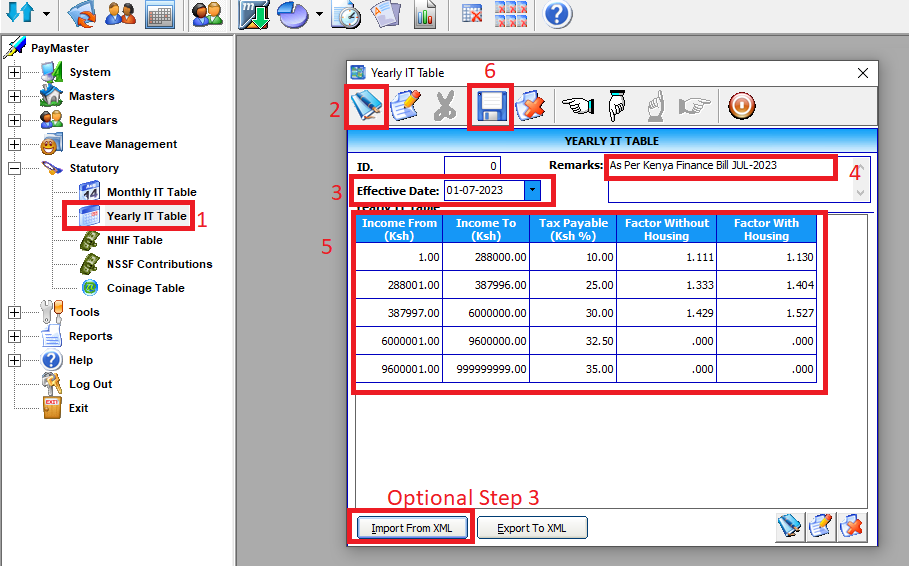

Yearly Tax Table

Note : You can even Import the Tax Table Directly via File distributed by Endeavour Africa Ltd. In this case Follow Step 1, 2 in Above screenshot. Then Proceed to Import From XML (Optional Step 3) & Click Save (Step 7)