- Home

- About us

- Products

Creative, Premium & Scalable Solutions For Business

HR Solution

Business Solution

Finance Solution

Add On Solution

- Partner Program

- Blog

- Contact Us

Following changes which affects Payroll Needs to be implemented Effective from 01JUL2023.

Important Note:

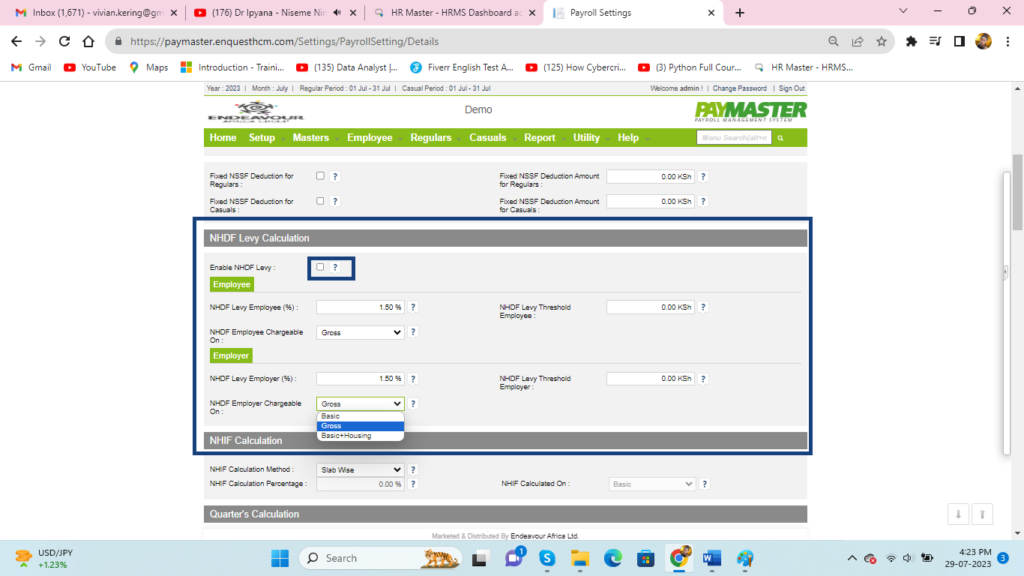

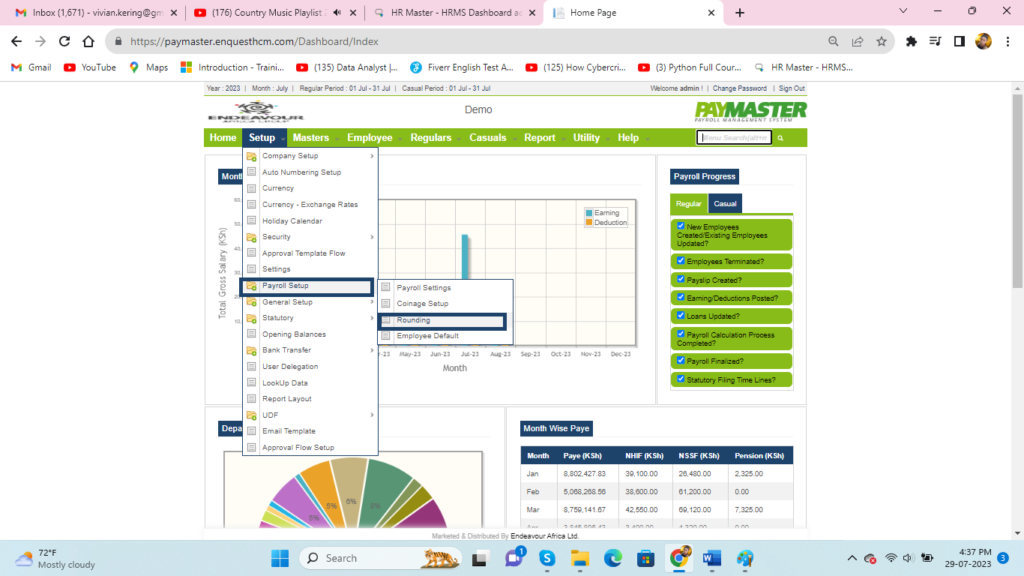

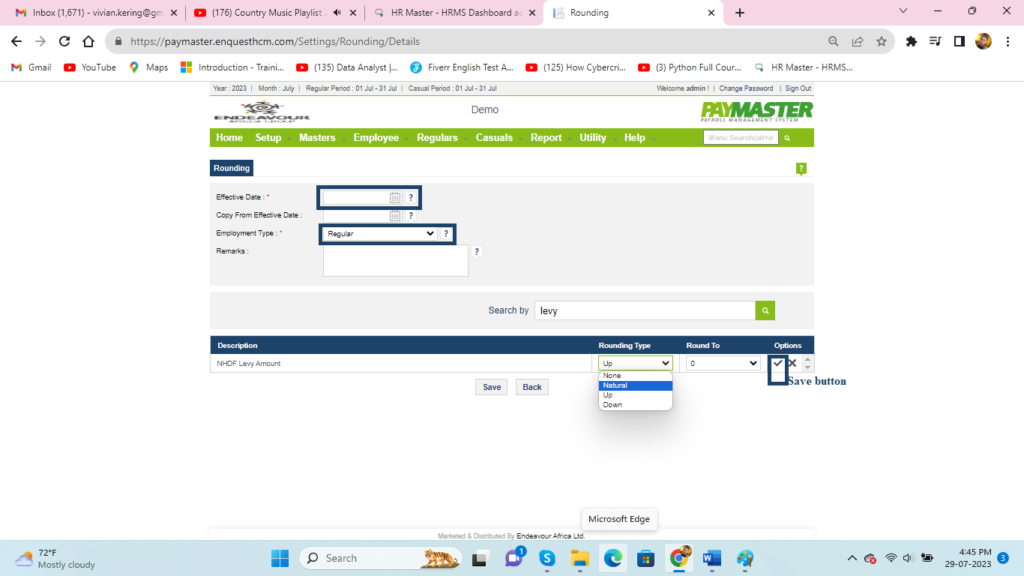

It is advisable to set Upward Rounding for National Housing Development Levy as mentioned in following screenshot

3. Click Add New

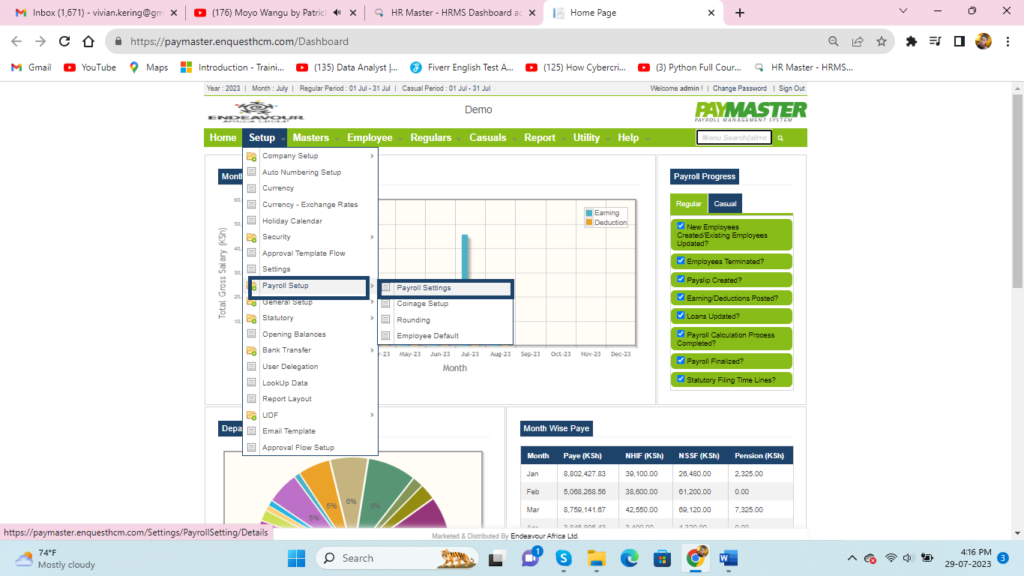

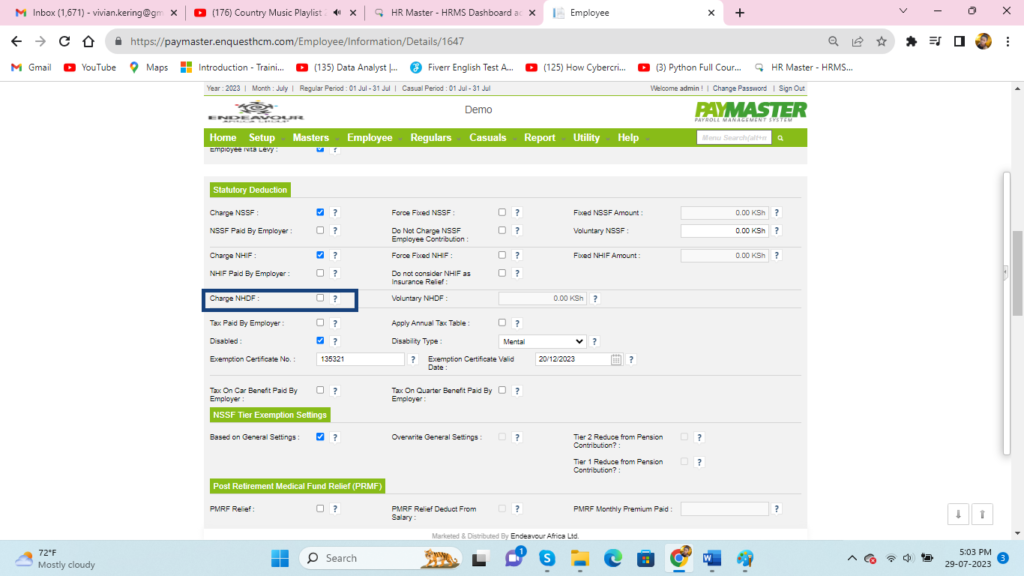

In Paymaster we have given an Option to Set NHDL at Employee Level, To Enable NHDL for all Employees follow these steps

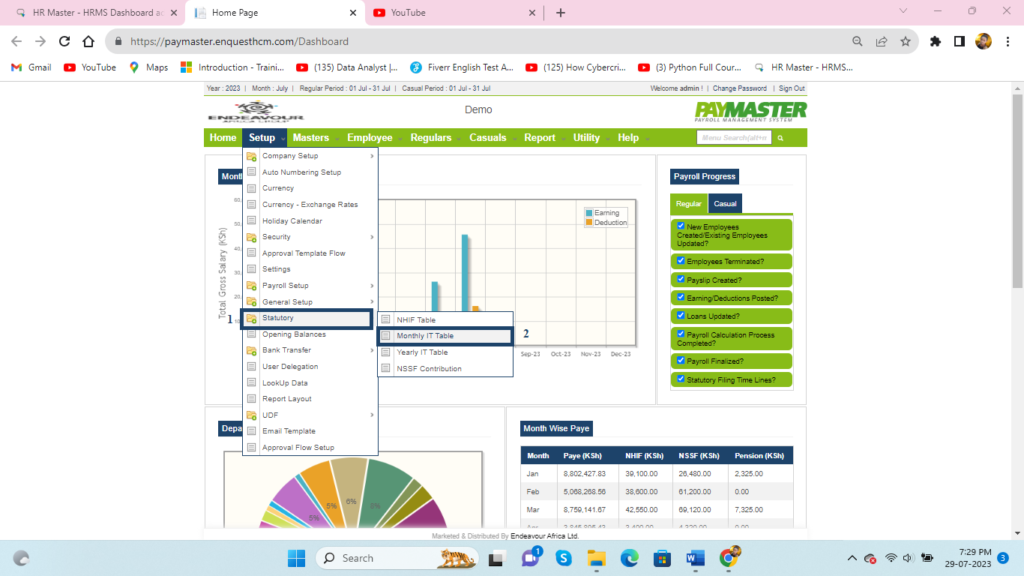

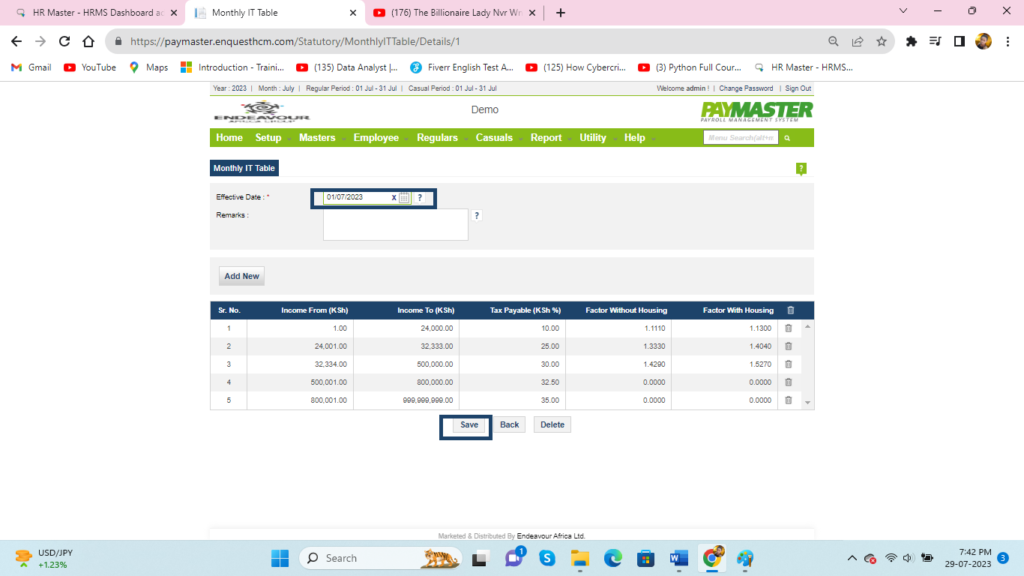

Monthly Tax Table

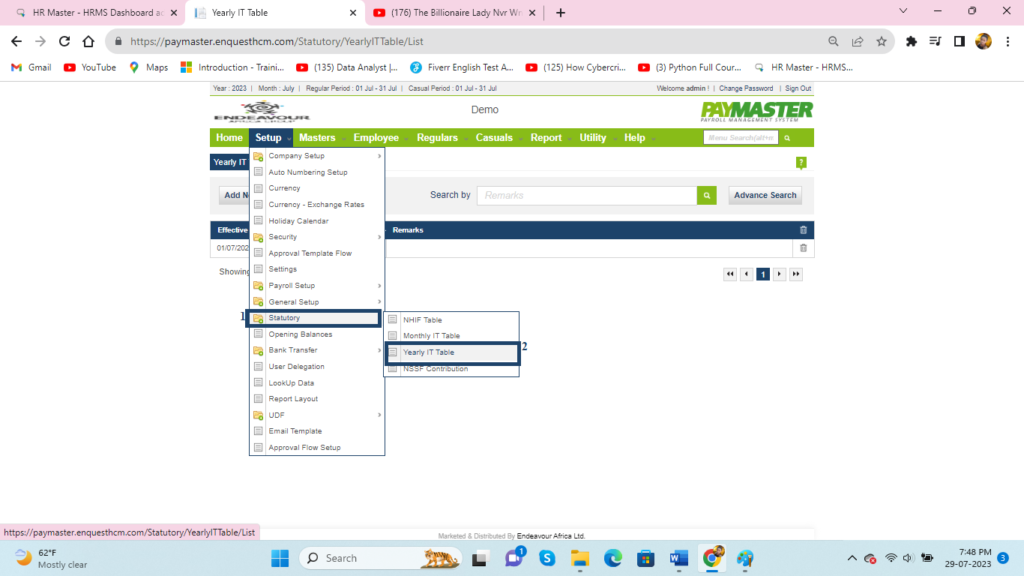

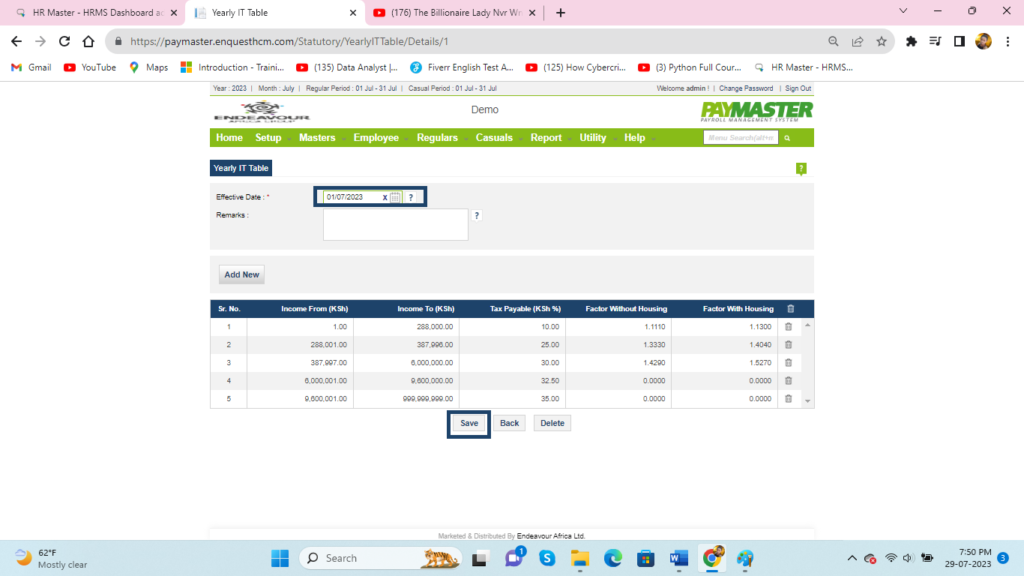

Yearly Tax Table